Fibe and Axis Bank Launch India's First Numberless Credit Card for Enhanced Security and Convenience

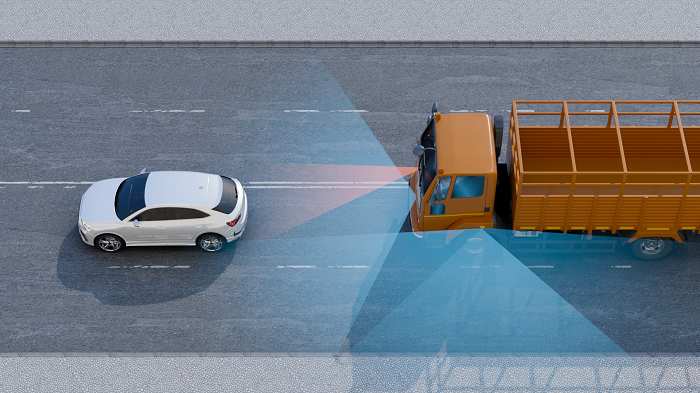

The innovative numberless credit card is designed to enhance security by omitting traditional card details such as the card number, expiry date, and CVV from the physical card.

Fibe, formerly known as EarlySalary, a prominent Indian Fintech company, has joined forces with Axis Bank, one of India's largest private sector banks, to unveil the country's pioneering numberless credit card tailored for the tech-savvy Generation Z. This groundbreaking collaboration marks a significant stride in the financial industry, offering heightened security and convenience to cardholders.

The innovative numberless credit card is designed to enhance security by omitting traditional card details such as the card number, expiry date, and CVV from the physical card. This measure significantly reduces the risk of identity theft and unauthorized access to a customer's sensitive financial information. Instead, customers can conveniently access their Fibe Axis Bank Credit Card details through the Fibe app, giving them complete control over their card information.

The co-branded credit card is loaded with industry-leading features, including a generous 3% cashback on online food delivery from all restaurant aggregators, local ridesharing apps, and entertainment purchases on online ticketing platforms. Additionally, customers will receive a 1% cashback on both online and offline transactions, making it a lucrative choice.

This pioneering card is powered by RuPay, allowing customers to link it to the Unified Payments Interface (UPI). It is accepted at all offline retail stores and digital platforms, featuring a convenient tap-and-pay functionality. Moreover, there are no joining fees or annual fees for the card's entire lifetime, ensuring cost-effectiveness for users. The card is initially available to Fibe's existing customer base of over 2.1 million users.

Beyond these benefits, cardholders can enjoy access to four domestic airport lounges annually, a fuel surcharge waiver for fuel spends ranging from Rs. 400 to Rs. 5,000, and exclusive offers like Axis Dining Delights, Wednesday Delights, End-of-Season Sales, and RuPay portfolio offerings available across all their cards.

Akshay Mehrotra, Co-Founder and CEO of Fibe, expressed his enthusiasm for the partnership with Axis Bank, stating, "This exceptional card represents a significant stride in our commitment to offering secure and inclusive financial solutions to the ambitious youth of India."

Sanjeev Moghe, President & Head of Cards & Payments at Axis Bank, emphasized the bank's commitment to innovation-led partnership models and its focus on expanding access to formal credit in India.

Fibe, renowned for its leadership in the personal loan segment for salaried professionals, is now extending its reach into the expansive credit card market. The company secured $110 million in Series D funding last year, underscoring its dedication to widening its geographic presence and diversifying its offerings. Fibe was recently honored as the Best Startup in Fintech at the G20 Digital Innovation Alliance Mega Summit, further solidifying its position as a fintech leader in India.

.jpg)

.jpeg)